Grant Application Portal Guide

Our Grant Application Portal makes it easy to submit applications and grant reports, and view past applications. Our Grant Application Portal Guide covers how to set up your account and how to apply for a grant.

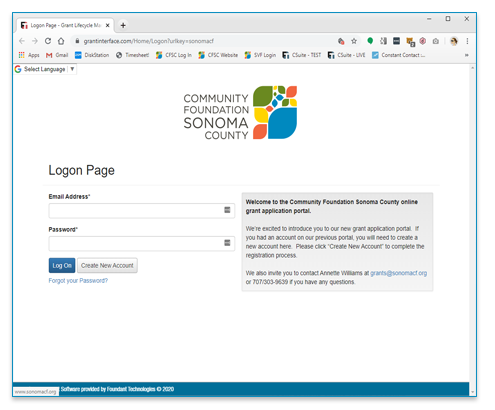

Grant Application Portal Login Page

Our Grant Application Portal makes it easy to submit applications and grant reports, and view past applications. Our Grant Application Portal Guide covers how to set up your account and how to apply for a grant.

Guide to Creating a Successful Grant Application

We have compiled several resources for applicants who may need assistance creating a successful proposal.

Grant Application Portal Login Page

Our Grant Application Portal makes it easy to submit applications and grant reports, and view past applications. Our Grant Application Portal Guide covers how to set up your account and how to apply for a grant.

How can my organization get in touch with the Community Foundation about our needs and programs?

We’d love to stay up to date with the current work of your organization so we can keep you in mind for funding opportunities. The best way to get in touch with us about your organization and the projects you are working on is to email our Community Impact Team with a brief update or a one-pager. This does not need to be a formal document; it can be as simple as an email with bullet points, on a quarterly or yearly basis. We want to hear from you!

Here’s what to include:

- Your organization’s current needs

- Any projects and programs

- Your target demographic

How can my organization receive a grant from the Community Foundation?

Our competitive grants are open to incorporated, charitable 501(c)(3) organizations serving Sonoma County. You may apply for a grant if your organization has a service or program that fits one of our fields of interest. All proposals are evaluated by our Community Impact Team using our grant review criteria and compared with other applications.

Please refer to our Competitive Grants table for more information.

Why are some of your grant programs by invitation only? How can I apply?

The Community Impact Team is sensitive to the resources required by nonprofits to apply for grants. We strive to avoid unnecessary expenditure of time and effort by ensuring that programs are a strong fit with funding prior to completing the application. We employ a trust-based approach to our grantmaking, assuming responsibility for researching and vetting projects in advance. If you believe you have a program that strongly aligns with the grant criteria, please feel free to send a brief summary of your program to grants@sonomacf.org.

What if I am seeking funding for a new project or program, but I am not part of a nonprofit organization?

Community Foundation Sonoma County grants are awarded to support a wide range of projects, from multi-year initiatives to grassroots community efforts.

Although we require that each grantee operate as a nonprofit entity with tax-exempt status under section 501(c)(3) of the Internal Revenue Code, we are aware that some worthwhile projects may not have this status.

Therefore, we will consider awarding grants for the activities of non-exempt groups (those that are not 501(c)(3) organizations) that have an established relationship with a fiscal sponsor that does have this tax-exempt status under the following circumstances:

- The non-exempt group operates as a not-for-profit and has an oversight committee or advisory board comprised of more than one individual.

- The program or project for which the non-exempt group is seeking funding falls within the tax-exempt purposes of the sponsoring organization, and the two groups have established a relationship prior to applying to the Foundation for funding (see Recommended Steps for Formalizing Sponsorship Relationship below).

- The program or project has submitted a signed copy of the Community Foundation Sonoma County Fiscal Sponsorship Agreement form. This form summarizes the terms of the relationship and the responsibilities of the non-exempt group and the fiscal sponsor and must be submitted with the application.

To learn more about formalizing a fiscal sponsor relationship, click here.

Where do I start?

Begin by answering the following questions:

- Is there a grantmaking program whose goals and criteria seem like a good match for my program?

- Does the timing of the grant program fit with my funding needs?

- Am I certain that none of my project expenditures are included in the items that the Community Foundation does not fund?

If you answer “yes” to all of the above questions and there is a grant program currently accepting applications, you can follow the link to our Apply for Grants page to apply online.

Are there specific forms I need and where do I get them?

All of our grant applications are submitted electronically. Please go to the Competitive Grants Table to find the online application and accompanying forms for your field of interest. Read more FAQs for Online Submission.

Is there a limit to the number of grants I can apply for in any given year?

You may apply to each program, as long as you meet the grant criteria. Generally, you may submit only one application per grant program per year. However, multi-service organizations (those that have distinct program departments serving different fields) may submit multiple applications.

If my organization receives a grant this year, may we apply for additional funding next year?

Yes, it is fine to reapply for additional years of support provided the grant goals and criteria still align with your program outcomes.

What does 501(c)(3) mean?

This refers to an Internal Revenue Service designation code that verifies that an organization is charitable, tax-exempt, and nonprofit. Community Foundation’s due diligence on grant applicants includes verifying 501(c)(3) status.

How and when will I know whether our proposal has been funded?

Our grantmaking criteria and timelines, including the dates when applicants will be notified if their proposals will be funded, will be posted on our website under the Apply for Grants page.

What is the Community Foundation and from where does its grant money come?

A brief description of community foundations can be found in our About Us section.

Community Foundation Sonoma County was founded in 1983 by a group of leading citizens who created endowment funds as a permanent source of funds supporting local nonprofit organizations. Program grants comprise about 20% percent of our total grantmaking with funds generated by designated payouts from endowment funds. Grants that honor a donor’s specific charitable intent comprise 80% of our grants and are recommended by individuals, groups, businesses and nonprofit organizations with established funds at the Community Foundation.[/vc_column_text][vc_empty_space height=”30px”][/qode_accordion_tab][qode_accordion_tab title=”Do I need to submit any legal or financial documents along with my application?”][vc_column_text]We routinely need your IRS employer ID number in order to verify your IRS charitable status.

Requesting financial information about your organization is a basic element in the review process of every funder. We try to keep our request to financial data that we know we need in order to make a funding decision.

Do I need to submit any legal or financial documents along with my application?

We routinely need your IRS employer ID number in order to verify your IRS charitable status.

Requesting financial information about your organization is a basic element in the review process of every funder. We try to keep our request to financial data that we know we need in order to make a funding decision.

For more information, please contact: